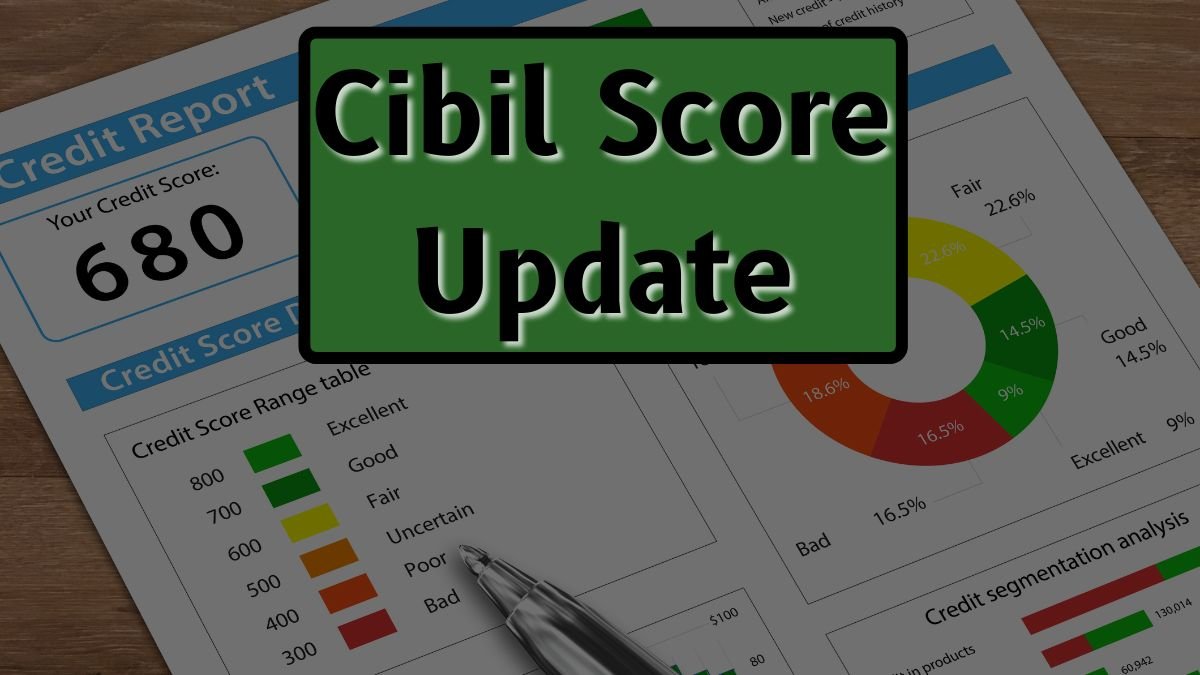

So here’s the deal. Your CIBIL score is basically a three-digit number (between 300–900) that shows how “trustworthy” you are when it comes to borrowing money. Higher the score, better your chances with banks.

But when your score is low? Doors start to close. Traditional lenders get nervous. And suddenly, the loan you really need feels out of reach.

But take a breath—you’ve got options.

Even with Bad Credit, These Doors Are Still Open

Here’s how people like you are getting loans, even with a less-than-perfect CIBIL score:

1. Apply for a Joint Loan

Got someone in your corner with a solid credit history? You’re in luck.

- Team up with a partner, spouse, sibling, or parent

- Their good credit helps balance out your bad

- You may even qualify for better interest rates

- Plus, the repayment load is shared

Real Talk: A friend of mine had a 540 credit score after job loss. His wife, though, had a clean slate. They applied together—and boom, loan approved.

2. Try Non-Banking Financial Companies (NBFCs)

Not every lender cares about your score as much as banks do.

- NBFCs offer personal loans with flexible criteria

- Yes, interest rates can be higher

- But if you need money now, this can be a lifeline

When banks say no, NBFCs often say yes. Just make sure the lender is legit—check reviews, licenses, and ratings.

3. Go for a Secured Loan

Got gold? Property? Even a fixed deposit?

You can use that as collateral.

- Gold loans are super common and fast

- Property-backed loans get approved easier

- Some lenders accept insurance policies or investments too

Why it works: Lenders feel safer when there’s something backing the loan. So they’re more likely to approve it—even if your CIBIL score is low.

4. Show Proof of a Stable Income

Money talks. If you’re earning steadily, even with bad credit, many lenders will still consider you.

- Submit salary slips, tax returns, or business income

- Offer to pay higher EMI or a bigger down payment

- Be honest—your story matters more than you think

One single mom I spoke to had a 520 score, but she showed steady income from her home bakery. She walked out with a small loan the same week.

Quick Overview: Loan Options with Bad CIBIL Score

| Option | Good For | Extra Tip |

|---|---|---|

| Joint Loan | If you have a co-applicant | Choose someone with strong credit |

| NBFC Personal Loan | Quick money with fewer checks | Compare multiple offers |

| Secured Loan | If you have gold/property/assets | Keep documents ready |

| Income-Based Loan | Stable job or business | Highlight consistency |

FAQ

Can I get a personal loan with a credit score under 600?

Yes. Many NBFCs and lenders offer loans even with scores under 600—especially if it’s a secured loan or you apply with a co-borrower.

Will applying for more loans hurt my credit score?

If you apply too many times in a short span, yes. Instead, research carefully and apply only where you’re likely to be approved.